Here, we introduce a shock to the wage equation. Table 17 presents the effect of a one off 1 percent shock to the constant in the Phillips curve of ADAM. After the shock the wage level is 1 percent above its equilibrium and it is up to the crowding out mechanism of ADAM to make the wage rate return to its baseline. (See experiment)

Table 17. The effect of a temporary increase in wage

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2010-Dkr. | |||||||||||

| Priv. consumption | fCp | 1057 | -251 | 733 | 1143 | 1353 | 1528 | 974 | 223 | -462 | -927 |

| Pub. consumption | fCo | 0 | 0 | 2 | 3 | 5 | 13 | 21 | 28 | 34 | 38 |

| Investment | fI | 26 | -230 | -473 | -351 | -230 | -35 | -207 | -348 | -372 | -310 |

| Export | fE | -1898 | -2581 | -3132 | -3645 | -4071 | -4926 | -4158 | -2508 | -721 | 646 |

| Import | fM | 486 | -337 | -98 | -45 | -88 | -465 | -767 | -778 | -567 | -273 |

| GDP | fY | -1171 | -2483 | -2376 | -2311 | -2291 | -2233 | -1869 | -1125 | -280 | 392 |

| 1000 Persons | |||||||||||

| Employment | Q | -1.89 | -3.12 | -3.59 | -3.86 | -4.05 | -4.27 | -3.59 | -2.28 | -0.86 | 0.22 |

| Unemployment | Ul | 1.17 | 1.85 | 2.09 | 2.23 | 2.34 | 2.46 | 2.06 | 1.30 | 0.48 | -0.14 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0.03 | 0.00 | -0.17 | -0.16 | -0.15 | -0.13 | -0.11 | -0.09 | -0.07 | -0.05 |

| Priv. saving surplus | Tfn_hc/Y | -0.07 | -0.02 | 0.12 | 0.09 | 0.06 | -0.01 | -0.02 | -0.01 | -0.01 | 0.00 |

| Balance of payments | Enl/Y | -0.04 | -0.02 | -0.05 | -0.08 | -0.09 | -0.14 | -0.13 | -0.10 | -0.07 | -0.05 |

| Foreign receivables | Wnnb_e/Y | -0.39 | -0.41 | -0.48 | -0.56 | -0.64 | -1.06 | -1.38 | -1.58 | -1.65 | -1.63 |

| Bond debt | Wbd_os_z/Y | -0.15 | -0.14 | 0.01 | 0.15 | 0.28 | 0.81 | 1.17 | 1.37 | 1.45 | 1.43 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | 0.08 | 0.14 | 0.15 | 0.14 | 0.14 | 0.15 | 0.12 | 0.06 | 0.01 | -0.03 |

| Labour intensity | hq/fX | 0.01 | 0.03 | 0.02 | 0.02 | 0.01 | 0.00 | -0.01 | -0.01 | -0.01 | -0.01 |

| User cost | uim | 0.29 | 0.30 | 0.29 | 0.29 | 0.29 | 0.24 | 0.15 | 0.06 | 0.00 | -0.03 |

| Wage | lna | 1.11 | 1.05 | 0.97 | 0.92 | 0.86 | 0.53 | 0.20 | -0.05 | -0.19 | -0.22 |

| Consumption price | pcp | 0.27 | 0.29 | 0.30 | 0.31 | 0.32 | 0.28 | 0.19 | 0.08 | 0.00 | -0.04 |

| Terms of trade | bpe | 0.20 | 0.21 | 0.21 | 0.22 | 0.22 | 0.17 | 0.10 | 0.03 | -0.02 | -0.04 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | 0.08 | 0.01 | -0.09 | -0.05 | -0.03 | 0.04 | 0.05 | 0.04 | 0.02 | 0.00 |

| Wage share | byw | 0.35 | 0.32 | 0.27 | 0.24 | 0.20 | 0.07 | -0.03 | -0.08 | -0.09 | -0.07 |

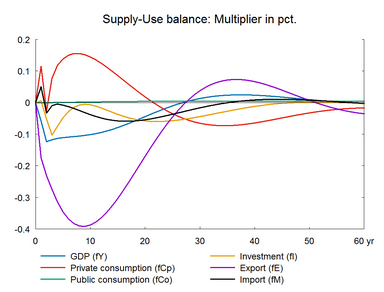

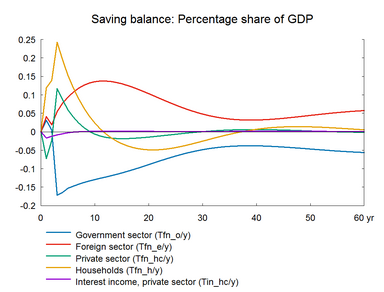

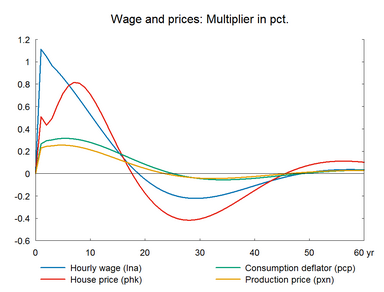

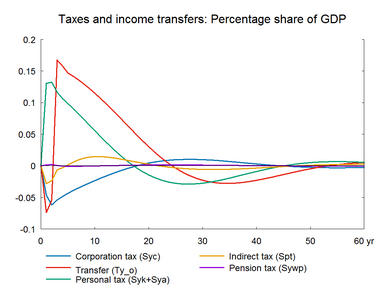

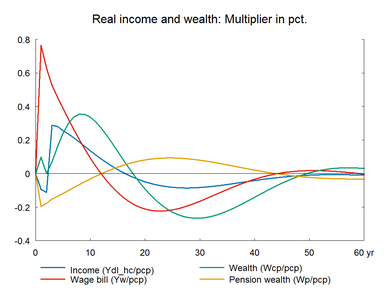

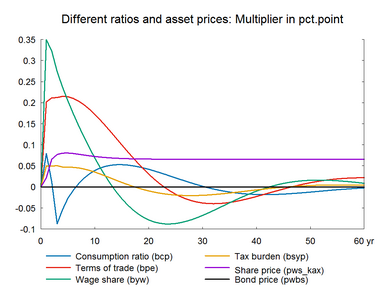

The higher wage has both a positive and negative effect on the economy. The former is due to the positive effect on real wages which raises private consumption. Two years after the wage increase, income transfers from the government increase, because the equation for the rate of income transfers depends on wages with a lag of two years. This further increases disposable income and consumption and worsens public finance.

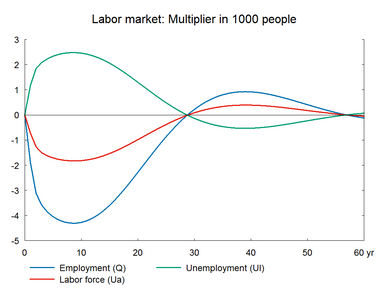

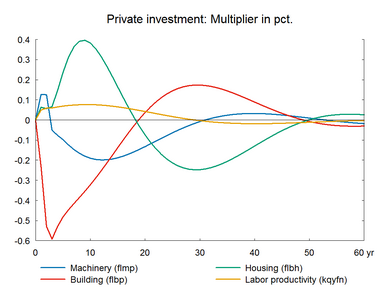

The negative demand effect arises due to a negative effect on the market share of Danish exports. The higher wage raises prices and worsens competitiveness, which leads to a fall in net exports. Consequently, production and employment fall. The lower production also drags investments down. In the short run, the negative effect is stronger and unemployment increases, i.e. the wage increase creates an economic downturn.

In the long run, the wage-driven crowding out returns unemployment and wage to the baseline.▼ The wage relation in ADAM is a Phillips curve, which links the changes in wages to unemployment. A fall/rise in unemployment pushes wages and hence prices upward/downward and reduces/improves competitiveness. So exports and production decrease/increase and over time unemployment returns to its baseline. This is the wage-driven crowding out process. In the long run, all variables return to their baseline except for a permanent negative impact on public and foreign debt, reflecting the accumulated budget impact in the transition period before the equilibrium is reestablished.

Note the symmetry of the model responses in the present experiment and the foreign price shock in section 8. A permanent 1 percent fall in foreign prices will trigger a similar adjustment process as the baseline wage will be 1 percent above its equilibrium after such a foreign price shock, cf. chapter 11 of the ADAM book.

Figure 17. The effect of a temporary increase in wage