The focus now shifts from the public sector to the foreign sector. Foreign trade is an essential part of the Danish economy. Exports are a key demand component and constitute about 50 percent of GDP. An increase in foreign demand for Danish products makes Danish firms expand production, and creates a positive impact on employment in the short run. Table 5 presents the effects of a permanent 0.20 percent increase in foreign demand without accompanying effects on foreign prices and foreign interest rates. The shock amounts to 0.1 percent of GDP in 2010 prices in the first year. (See experiment)

Table 5. The effect of a permanent increase in foreign demand

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2010-Dkr. | |||||||||||

| Priv. consumption | fCp | 50 | 251 | 353 | 402 | 433 | 586 | 797 | 980 | 1087 | 1134 |

| Pub. consumption | fCo | 0 | 0 | 0 | 0 | 0 | -1 | -2 | -4 | -6 | -8 |

| Investment | fI | 496 | 734 | 559 | 459 | 424 | 277 | 234 | 241 | 244 | 237 |

| Export | fE | 1621 | 1624 | 1623 | 1592 | 1543 | 1106 | 650 | 391 | 350 | 463 |

| Import | fM | 1164 | 1355 | 1313 | 1294 | 1307 | 1322 | 1346 | 1392 | 1458 | 1551 |

| GDP | fY | 992 | 1244 | 1216 | 1155 | 1094 | 671 | 380 | 278 | 288 | 350 |

| 1000 Persons | |||||||||||

| Employment | Q | 0,78 | 1,22 | 1,36 | 1,40 | 1,37 | 0,75 | 0,14 | -0,16 | -0,23 | -0,19 |

| Unemployment | Ul | -0,42 | -0,63 | -0,69 | -0,70 | -0,69 | -0,37 | -0,07 | 0,08 | 0,12 | 0,10 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0,02 | 0,03 | 0,04 | 0,03 | 0,03 | 0,02 | 0,00 | 0,00 | 0,00 | 0,00 |

| Priv. saving surplus | Tfn_hc/Y | 0,00 | -0,02 | -0,02 | -0,01 | -0,01 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 |

| Balance of payments | Enl/Y | 0,02 | 0,01 | 0,02 | 0,02 | 0,02 | 0,02 | 0,01 | 0,00 | -0,01 | -0,01 |

| Foreign receivables | Wnnb_e/Y | -0,01 | -0,02 | -0,01 | 0,00 | 0,01 | 0,06 | 0,08 | 0,07 | 0,04 | 0,01 |

| Bond debt | Wbd_os_z/Y | -0,03 | -0,07 | -0,10 | -0,13 | -0,16 | -0,24 | -0,24 | -0,20 | -0,16 | -0,12 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0,07 | -0,07 | -0,06 | -0,05 | -0,04 | 0,00 | 0,02 | 0,03 | 0,03 | 0,03 |

| Labour intensity | hq/fX | -0,04 | -0,04 | -0,03 | -0,03 | -0,02 | -0,01 | -0,02 | -0,02 | -0,02 | -0,02 |

| User cost | uim | 0,00 | 0,00 | 0,01 | 0,02 | 0,02 | 0,06 | 0,08 | 0,08 | 0,08 | 0,07 |

| Wage | lna | 0,01 | 0,03 | 0,05 | 0,08 | 0,10 | 0,20 | 0,24 | 0,24 | 0,22 | 0,20 |

| Consumption price | pcp | 0,00 | 0,01 | 0,02 | 0,03 | 0,04 | 0,08 | 0,11 | 0,12 | 0,12 | 0,11 |

| Terms of trade | bpe | 0,00 | 0,01 | 0,01 | 0,02 | 0,02 | 0,05 | 0,07 | 0,07 | 0,06 | 0,06 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0,03 | -0,01 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,01 | 0,01 | 0,01 |

| Wage share | byw | -0,01 | -0,01 | 0,00 | 0,01 | 0,02 | 0,04 | 0,04 | 0,03 | 0,03 | 0,02 |

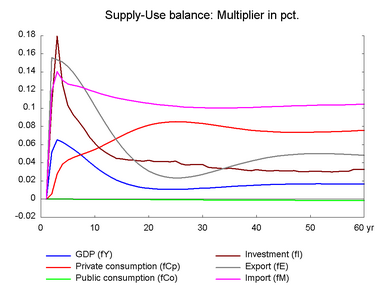

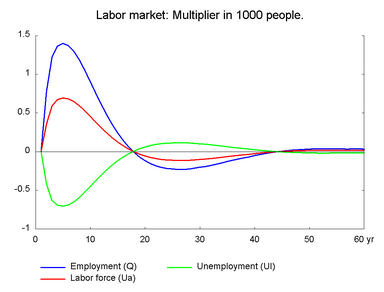

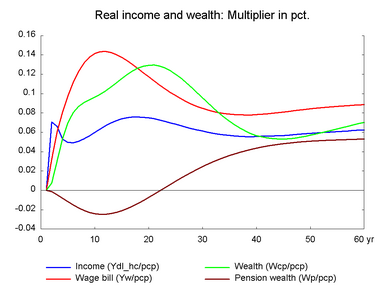

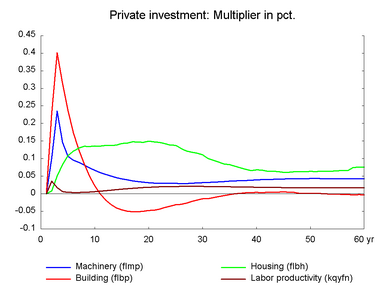

Exports immediately increase relative to the baseline reflecting the positive shock in foreign demand. However, the initial increase in exports is less than 1000 million as the average short run export demand elasticity is less than one. The higher exports make domestic production and employment expand, see more on the income multiplier process in section 1. As production expands the demand for capital and other factors of production increases, and hence investment increases relative to the baseline. This is reflected on the higher accelerator effect on investment.▼ The accelerator effect is when an increase in production results in a proportionately larger rise in investment. An ‘x’ percent increase in production requires an ‘x’ percent increase in capital. Since capital stock is larger than annual investment, ‘x’ percent increase in capital requires a more than ‘x’ percent increase in investment. Investments increase also due to the substitution effect.▼ A substitution effect arises when a change in the relative prices of factors induces producers to use more of a relatively cheaper factor and less of a relatively more expensive factor.

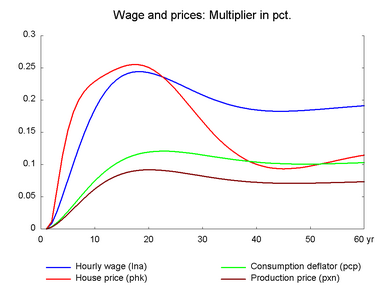

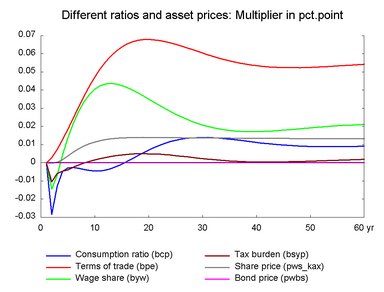

The expansion of the domestic economy increases the export prices relative to the baseline. This is because export prices reflect production cost and the higher employment puts upward pressure on wages and hence on the cost of production. As prices grow relative to the baseline, competitiveness worsens, which dampens exports and stimulates imports. Because of this the long term effect on export volumes is smaller than the initial export demand shock, see more about the crowding out process in section 2. Private consumption increases permanently due to the positive real wage effect.▼ Real wage effect arises because wages increase/decrease more than the general price levels due to the deadweight from the non-responding exogenous import prices. This creates a positive/negative real wage effect and real disposable income and private consumption increase/decrease permanently.

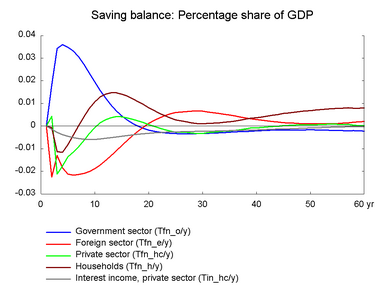

Imports also expand due to an increase in domestic economic activity in the short run. The higher export prices increase earnings from exports, but higher imports have a negative effect on the trade balance. The net result is a small improvement in the trade balance.

The long-term positive effect on the balance of payments is also a result of higher interest income from abroad. In contrast to the previous public demand shocks, it is now the budget balance of the foreign sector that deteriorates permanently while the public budget balance improves in the long term. It is not necessary to consider a tax increase in order to keep public debt unchanged. On the contrary, it is possible to loosen the fiscal policy slightly. In general, higher foreign demand is a demand shock similar to higher government purchases, but the shocks differ considerably concerning their long-term effects on public budget sustainability and on the balance of payments.

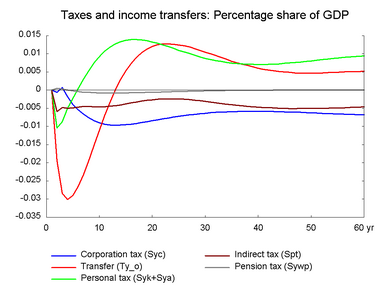

Figure 5. The effect of a permanent increase in foreign demand