The experiments above have demonstrated that the public budget could either end up in deficit or in surplus depending on the effect on public revenues or expenditures. This happens because there is no automatic fiscal reaction function in ADAM that can be activated in order to keep the public budget in balance. The following two experiments show the effects of a demand shock and a supply shock, respectively, when the public budget is kept in balance through a change in the income tax rates.

Table 18 presents the effect of a permanent increase in government purchase of goods, financed by higher income taxes. The public purchase of goods and services is increased by 1000 million, in 2000 prices. The state income tax rates are permanently raised by 1.1 per cent and the capital tax is temporarily raised by a lump sum of 0.17 per cent of GDP in the first year only. (See experiment)

Table 18. The effect of a permanent increase in public spending, balanced budget

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | -358 | -616 | -811 | -983 | -1112 | -1367 | -1348 | -1279 | -1240 | -1254 |

| Pub. consumption | fCo | 977 | 1004 | 1032 | 1058 | 1082 | 1179 | 1261 | 1345 | 1440 | 1548 |

| Investment | fI | 214 | 141 | -108 | -193 | -235 | -307 | -236 | -154 | -108 | -111 |

| Export | fE | -45 | -58 | -78 | -99 | -119 | -153 | -106 | -88 | -155 | -282 |

| Import | fM | 349 | 227 | 29 | -52 | -91 | -108 | 8 | 118 | 178 | 182 |

| GDP | fY | 543 | 352 | 120 | -43 | -162 | -382 | -268 | -118 | -52 | -76 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.67 | 0.66 | 0.47 | 0.27 | 0.08 | -0.30 | -0.09 | 0.17 | 0.25 | 0.18 |

| Unemployment | Ul | -0.50 | -0.45 | -0.30 | -0.17 | -0.04 | 0.21 | 0.06 | -0.12 | -0.17 | -0.12 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0.16 | 0.01 | 0.00 | -0.01 | -0.02 | -0.04 | -0.03 | -0.02 | -0.02 | -0.02 |

| Priv. saving surplus | Tfn_hc/Y | -0.19 | -0.03 | 0.00 | 0.01 | 0.02 | 0.04 | 0.02 | 0.01 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | -0.03 | -0.02 | -0.01 | 0.00 | 0.00 | 0.00 | -0.01 | -0.01 | -0.02 | -0.02 |

| Foreign receivables | Wnnb_e/Y | -0.03 | -0.04 | -0.05 | -0.05 | -0.05 | -0.03 | -0.04 | -0.08 | -0.13 | -0.19 |

| Bond debt | Wbd_os_z/Y | -0.16 | -0.16 | -0.14 | -0.13 | -0.10 | 0.06 | 0.19 | 0.26 | 0.30 | 0.33 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.07 | -0.06 | -0.05 | -0.04 | -0.04 | -0.05 | -0.08 | -0.09 | -0.09 | -0.09 |

| Labour intensity | hq/fX | -0.05 | -0.04 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 | -0.03 |

| User cost | uim | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.01 |

| Wage | lna | 0.01 | 0.02 | 0.03 | 0.03 | 0.03 | 0.02 | 0.00 | 0.00 | 0.02 | 0.04 |

| Consumption price | pcp | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.01 |

| Terms of trade | bpe | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | 0.01 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | 0.02 | 0.00 | -0.01 | -0.02 | -0.03 | -0.05 | -0.04 | -0.03 | -0.02 | -0.02 |

| Wage ratio | byw | -0.01 | 0.00 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | 0.01 | 0.02 |

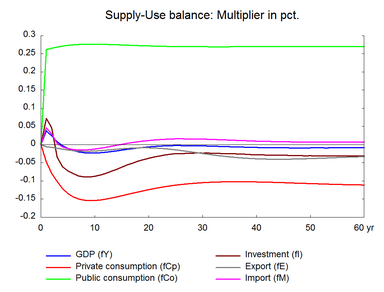

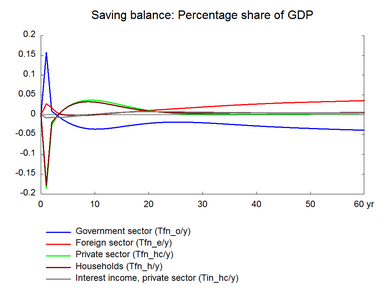

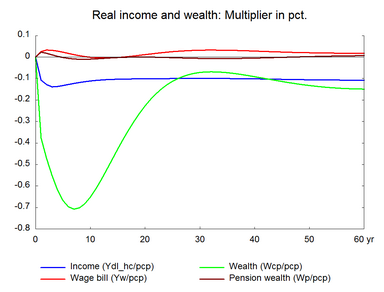

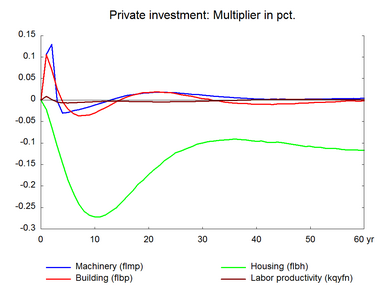

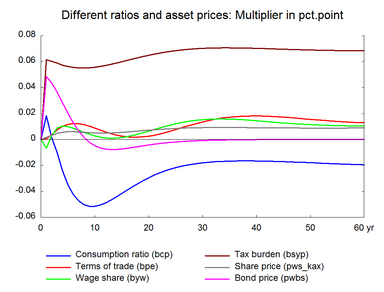

In contrast to unfinanced expenditures, now the long term effect on government debt is zero. There are two opposing effects - expansionary and contractionary effects. The former is due to the increase in public expenditures that increases domestic demand and there by production and employment. The latter is due to the increase in income tax rates which reduces disposable income and there by private consumption. In the very short term the expansionary effects are stronger and production and employment expands. Investments also expand reflecting the increase in business investments on machinery and buildings.

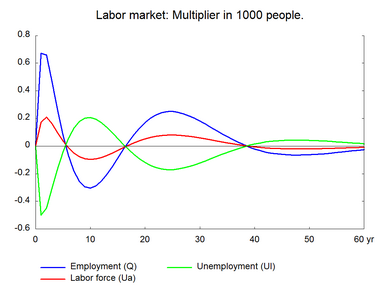

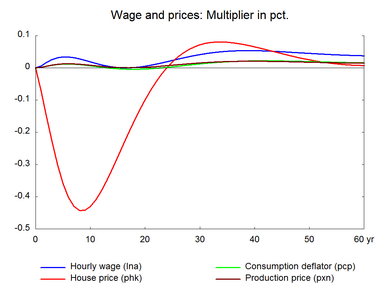

The overall positive effect occurs because private consumption reacts to tax increases with delay. Later on, the tax increase reduces consumption as disposable income falls. As a result, employment falls. With a financed public purchase, it takes only 4 years for the initial increase in employment to disappear and it takes almost the same year for employment to return to the baseline. The fall in private consumption reduces the demand for housing, and investment in housing and house prices fall. In the long run private consumption and investment falls permanently due to the permanent fall in disposable income. Investments also fall permanently in the long run due to the fall in residential investment.

The effect on unemployment oscillates before reaching equilibrium reflecting the fluctuation in the housing market. In general, with unfinanced public purchase experiment it is exports that fall and make room for the public purchase of goods and services, with a tax-financed public purchase experiment, it is the private domestic demand that falls to make room for the public purchase of goods and services. The public budget can be financed in various ways, and the outcomes depend on the ways of financing.

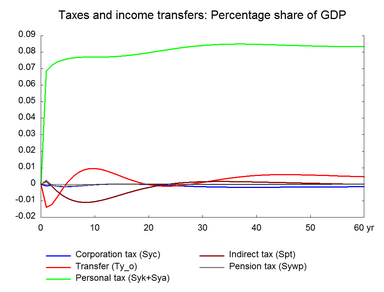

Figure 18. The effect of a permanent increase in public spending, balanced budget