The focus now shifts from the public sector to the foreign sector. Foreign trade is an essential part of the Danish economy. Exports are a key demand component and constitute about 50 per cent of GDP. An increase in foreign demand for Danish products makes Danish firms expand production, and employment increases in the short run. Table 5 presents the effects of a permanent 0.115 per cent increase in foreign demand without accompanying effects on foreign prices and foreign interest rates. The shock amounts to a 1000 million kroner increase in exports in 2005 prices in the first year. (See experiment)

Table 5. The effects of a permanent increase in foreign demand

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 39 | 200 | 257 | 255 | 244 | 317 | 464 | 569 | 612 | 626 |

| Pub. consumption | fCo | -8 | -10 | -9 | -8 | -7 | -4 | -2 | -1 | -1 | 0 |

| Investment | fI | 302 | 527 | 381 | 287 | 226 | 131 | 152 | 167 | 169 | 167 |

| Export | fE | 868 | 821 | 826 | 787 | 759 | 527 | 320 | 191 | 148 | 169 |

| Import | fM | 678 | 840 | 791 | 735 | 705 | 674 | 699 | 719 | 736 | 771 |

| GDP | fY | 512 | 685 | 654 | 581 | 514 | 304 | 246 | 222 | 209 | 208 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.52 | 0.88 | 0.99 | 0.97 | 0.90 | 0.41 | 0.13 | -0.01 | -0.09 | -0.11 |

| Unemployment | Ul | -0.27 | -0.45 | -0.49 | -0.47 | -0.44 | -0.20 | -0.06 | 0.01 | 0.04 | 0.05 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | 0.01 | 0.02 | 0.03 | 0.02 | 0.02 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 |

| Priv. saving surplus | Tfn_hc/Y | 0.00 | -0.02 | -0.02 | -0.01 | -0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | 0.01 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 |

| Foreign receivables | Wnnb_e/Y | -0.01 | -0.02 | -0.02 | -0.01 | 0.00 | 0.04 | 0.06 | 0.06 | 0.05 | 0.04 |

| Bond debt | Wbd_os_z/Y | -0.02 | -0.05 | -0.08 | -0.10 | -0.12 | -0.17 | -0.17 | -0.16 | -0.14 | -0.12 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.04 | -0.04 | -0.03 | -0.03 | -0.02 | 0.00 | 0.02 | 0.02 | 0.03 | 0.03 |

| Labour intensity | hq/fX | -0.03 | -0.02 | -0.02 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 |

| User cost | uim | 0.00 | 0.00 | 0.01 | 0.01 | 0.02 | 0.03 | 0.04 | 0.05 | 0.04 | 0.04 |

| Wage | lna | 0.01 | 0.02 | 0.04 | 0.06 | 0.07 | 0.13 | 0.15 | 0.16 | 0.15 | 0.14 |

| Consumption price | pcp | 0.00 | 0.01 | 0.01 | 0.02 | 0.03 | 0.05 | 0.07 | 0.08 | 0.08 | 0.08 |

| Terms of trade | bpe | 0.00 | 0.01 | 0.01 | 0.02 | 0.02 | 0.03 | 0.04 | 0.04 | 0.04 | 0.04 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 |

| Wage share | byw | -0.01 | 0.00 | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 |

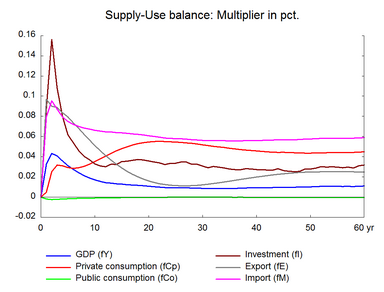

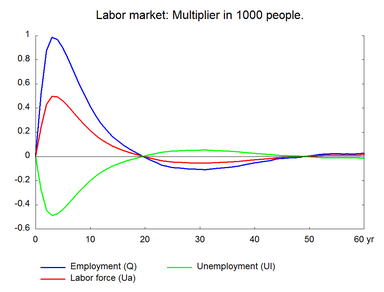

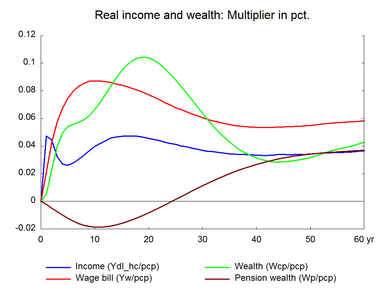

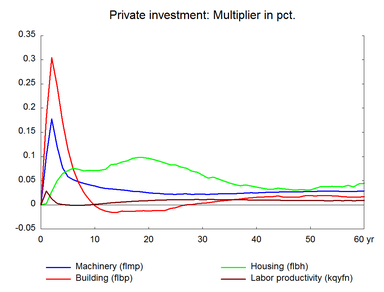

Exports increase immediately reflecting the increase in foreign demand. However, the initial increase in exports is less than 1000 million as the average short run export demand elasticity is less than one. The higher exports makes domestic production and employment expand, see more on the income multiplier process in section 1. As production increases the demand for capital and other factors of production increases, and hence investment increases. This is reflected on the higher accelerator impact on investment. Investments increase also due to the substitution effect.

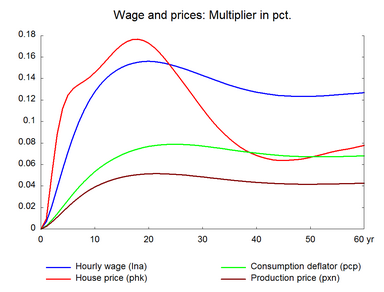

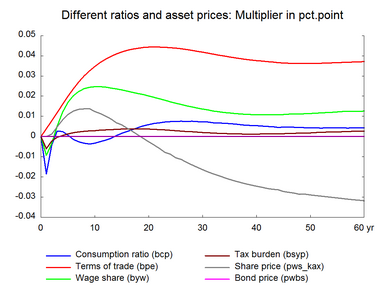

The expansion of the domestic economy increases the export prices. This is because export prices reflect production cost and the higher employment puts upward pressure on wages and hence on the cost of production. As prices grow relative to the baseline, competitiveness worsens, which dampens exports and stimulates imports. Because of this the long term effect on export volumes is smaller than the initial export demand shock, see more about the crowding out process in section 2. Wages increase more than the general price levels due to the deadweight from the non-responding exogenous import prices. This creates a real wage effect and real disposable income and private consumption increase permanently.

Imports also increase due to an increase in domestic economic activity in the short run. The higher export prices increase earnings from exports, but higher imports have a negative effect on the trade balance. The net result is a small improvement in the trade balance.

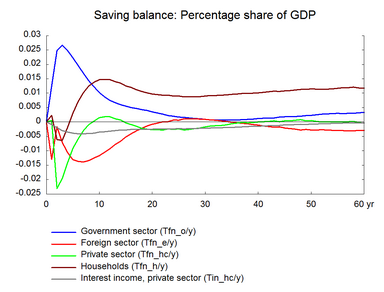

The long-term positive effect on the balance of payments is also a result of higher interest income from abroad. In contrast to the previous public demand shocks, it is now the budget balance of the foreign sector that deteriorates permanently while the public budget balance improves in the long term. It is not necessary to consider a tax increase in order to keep public debt unchanged. On the contrary, it is possible to loosen the fiscal policy slightly. In general, higher foreign demand is a demand shock similar to higher government purchases, but the shocks differ considerably concerning their long-term effects on public budget sustainability and on the balance of payments.

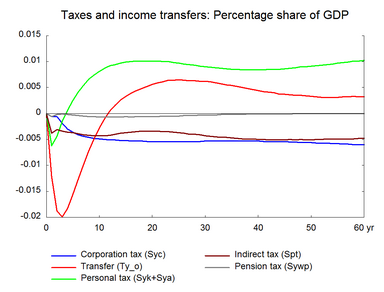

Figure 5. The effects of a permanent increase in foreign demand