Instead of investment in buildings, public investments in machinery can be increased to boost economic activity. The short-term expansionary effect is smaller due to the high import content of machinery. Government investment in machinery is increased permanently by 5 per cent of the baseline, which corresponds to 1000 million kroner in 2005 prices in the first year. (See experiment)

Table 4. The effect of a permanent increase in public investment in machinery

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 10 | 74 | 98 | 101 | 106 | 215 | 349 | 436 | 458 | 443 |

| Pub. consumption | fCo | -10 | 151 | 286 | 400 | 495 | 784 | 904 | 956 | 978 | 987 |

| Investment | fI | 865 | 944 | 890 | 842 | 816 | 779 | 802 | 802 | 791 | 776 |

| Export | fE | -36 | -68 | -107 | -149 | -196 | -461 | -710 | -895 | -996 | -1025 |

| Import | fM | 465 | 530 | 512 | 488 | 476 | 463 | 453 | 421 | 380 | 354 |

| GDP | fY | 347 | 556 | 649 | 706 | 751 | 876 | 923 | 914 | 890 | 870 |

| 1000 Persons | |||||||||||

| Employment | Q | 0.33 | 0.54 | 0.61 | 0.62 | 0.59 | 0.34 | 0.13 | -0.02 | -0.13 | -0.16 |

| Unemployment | Ul | -0.17 | -0.27 | -0.30 | -0.30 | -0.29 | -0.17 | -0.06 | 0.01 | 0.06 | 0.08 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.04 | -0.03 | -0.03 | -0.04 | -0.04 | -0.05 | -0.06 | -0.07 | -0.08 | -0.08 |

| Priv. saving surplus | Tfn_hc/Y | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Balance of payments | Enl/Y | -0.03 | -0.04 | -0.04 | -0.04 | -0.04 | -0.05 | -0.06 | -0.07 | -0.08 | -0.08 |

| Foreign receivables | Wnnb_e/Y | -0.05 | -0.10 | -0.14 | -0.19 | -0.23 | -0.43 | -0.64 | -0.87 | -1.08 | -1.29 |

| Bond debt | Wbd_os_z/Y | 0.02 | 0.04 | 0.07 | 0.10 | 0.13 | 0.31 | 0.51 | 0.71 | 0.92 | 1.11 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | 0.00 | 0.00 | 0.01 | 0.02 | 0.02 | 0.04 | 0.05 | 0.06 | 0.06 | 0.06 |

| Labour intensity | hq/fX | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.02 | -0.02 | -0.02 | -0.02 | -0.02 |

| User cost | uim | 0.16 | 0.24 | 0.31 | 0.36 | 0.41 | 0.52 | 0.54 | 0.53 | 0.50 | 0.47 |

| Wage | lna | 0.00 | 0.01 | 0.02 | 0.04 | 0.05 | 0.09 | 0.11 | 0.11 | 0.11 | 0.09 |

| Consumption price | pcp | 0.00 | 0.01 | 0.01 | 0.02 | 0.02 | 0.04 | 0.05 | 0.06 | 0.06 | 0.06 |

| Terms of trade | bpe | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| Percentage-point | |||||||||||

| Consumption ratio | bcp | -0.01 | -0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 |

| Wage share | byw | 0.00 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.01 | -0.02 |

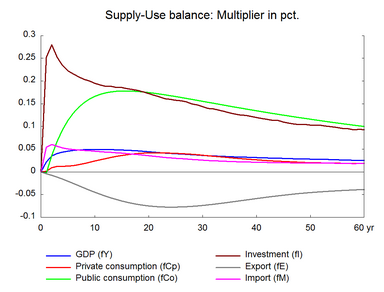

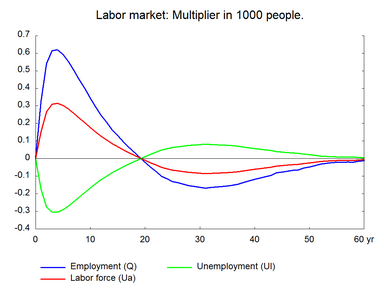

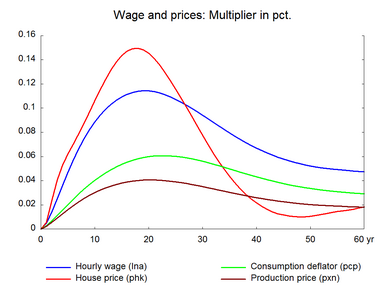

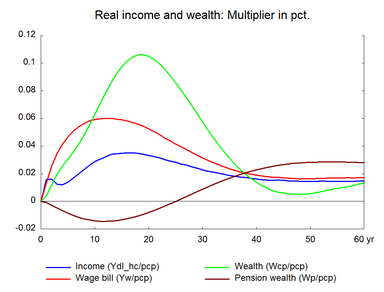

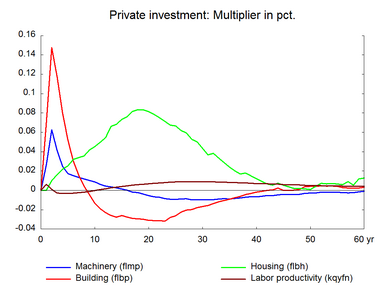

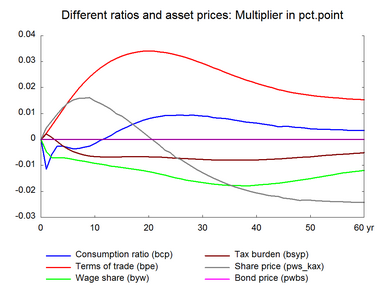

Like building investments, machinery investments have expansionary effects on the economy in the short run. Investment in machinery increases demand in the short run, which translates into higher production and employment. The lower unemployment will increase wage growth and reduce competitiveness. As competitiveness falls, exports fall and imports rise. Over time, the loss of competitiveness implies that unemployment returns to equilibrium. The expansionary effect of machinery investments is smaller because the import content of machinery investments is higher than that of building investments. The smaller effect on domestic activity effect implies that the pressure on wages and prices is smaller. And the resulting real wage effect on consumption is also lower.

It is also worth noting that the impact on total investment is smaller when investing in machines than when investing in buildings. This is because the accelerator impact is smaller. Machines are used for a shorter time period and the ratio between the stock of machinery and investment is smaller.

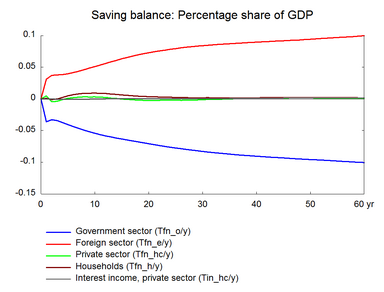

Note that the smaller impact on domestic production and income implies stronger deterioration of public budget in the short run than when public building investments or the public purchase of goods and services increase. This is, however, not evident from the tables above. It is because this and the previous three shocks are made comparable in fixed prices, i.e. the shocks are calibrated to have an impact of 1000 million kroner in 2005 prices in the public budget in the first year. It would be natural to make the shocks comparable in current prices. For example, due to among others the falling computer prices, the price deflator to machinery is less than that of building investments. Correcting for prices would make the calibrated shock in building investments smaller. Due to the smaller economic activity effect in the present experiment, the short run deterioration in the public budget will be larger in the present experiment than in building investment experiment. It should also be noted that the modest accompanying increase in government consumption reflects that the higher government stock of capital triggers an increase in depreciation, which is part of government consumption.

The four demand experiments discussed so far have similar effects on the domestic economy. They differ in terms of the magnitude of the impact on economic activity. An increase in government employment has the largest impact on the domestic economy as it has no direct link to imports. An increase in government investment in machinery has the smallest impact on the domestic economy as the import content of machinery investments is high. Similarly, the long-term impact on government budget is the highest in the former and the smallest in the latter. One has to be aware that the shocks have to be comparable in current prices when comparing the different experiments.

All the experiments are considered without funding and the public budget balance deteriorates permanently. The public expenditure can be financed by reducing other public expenditures or by increasing revenues. Section 18 below demonstrates financing the public purchase of goods and services by raising income taxes. If income taxes are raised to finance public expenditures there will be no positive effect on private consumption as real disposable income permanently falls, consequently competitiveness will not necessarily deteriorate.

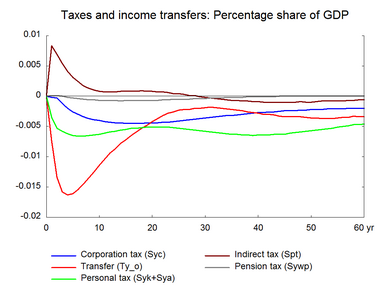

Figure 4. The effect of a permanent increase in public investment in machinery